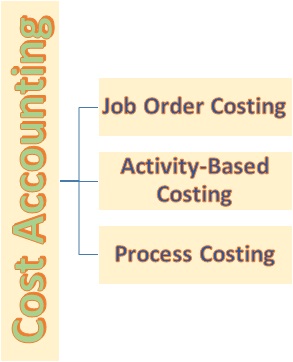

Cost Accounting

Cost accounting or costing is the process of tracking and monitoring the resources used in producing goods and services. Costing accounting is becoming very popular managerial and accounting field.Tracking costs is important in staying competitive for any given company, and thus the study and understanding of the costing principles and applications is important to managers in a position of making company decisions.

Costing accounting is important because it allows managers to understand the unit cost of a product and thus, determine the best selling price of the product.

The three costs used in manufacturing cost accounting are direct labor, direct material and overhead costs (fixed or variable).

Direct labor − These are the direct costs used to produce a given product.

Direct materials − These are the costs of raw materials used for the production of a given product.

Manufacturing overhead − These are the indirect costs used in the production of a given product. Manufacturing overhead can be either fixed or variable.

There are two major cost accounting methods used to determine the manufacturing costs namely: